Credit card security concerns SOLVED

Hi NachoNacho fan,

Your marketer used your corporate credit card to buy contact lists from a second-tier vendor. Two weeks later, you notice a large charge on your credit card that you don’t recognize. You realize the vendor’s data has been compromised, and your credit card is now floating around the web. Panic ensues. You call your bank to cancel the credit card and request a new one. The new one arrives three days later. You now spend two hours giving the new card’s details to 30 other legitimate vendors who had your original card.

Sounds familiar? It’s happened to most of us.

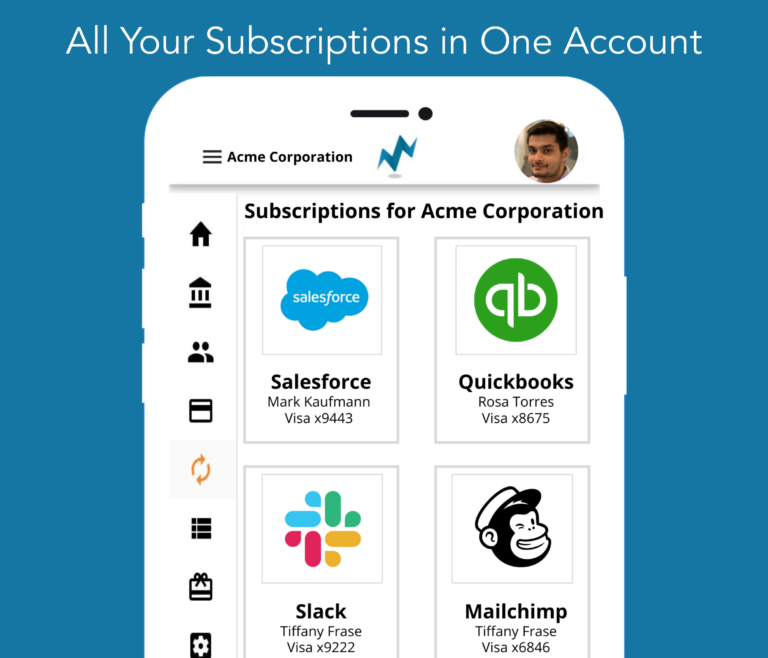

How about using a separate credit card for each vendor, with tight limits per card?

1. Spending limits on each card minimize the effects of any nefarious activities

2. If you see any unrecognizable charges, you’ll immediately know which vendor was the culprit

3. If a card is compromised, you can cancel it with one click and create a new one in seconds

4. None of the other vendors will be affected through this entire process

Sounds good, right? Try it out on your own!

Best,

The NachoNacho Team