Use Business Credit Cards with Added Privacy

The subscription pricing structure lies at the heart of the SaaS business model. Businesses around the globe look to SaaS subscriptions in order to streamline their workflow and drive productivity, especially in the process of scaling. The growing prevalence of SaaS has been highlighted in Blissfully’s annual SaaS report – indicating an average of at least 8 apps used per employee within a company. Such usage volume means that companies are spending more than the cost of a new Macbook Pro on annual SaaS spending per employee.

Although companies are increasingly operating on SaaS, managing these subscriptions continues to present challenges – particularly provoking concerns of privacy. Protecting payment information is imperative: as our degree of virtual connectivity accelerates, we face a growing risk of data breaches. In 2019, over 1,400 breaches were reported, exposing more than 160 million sensitive records. These numbers represent a 17% increase over the previous year. With this in mind, how can we go about our subscription spending in a more private and secure manner?

Alternate Browsers

Often the first choice for many, secure browsers or browser extensions introduce a certain degree of security without much added effort. Browsers such as DuckDuckGo disable search tracking and user information storage, which prevents ad targeting or personalized search results. Similarly, Google Chrome’s incognito browser doesn’t track visited sites, but lacks the encryption provided by DuckDuckGo. Although a good starting point, browsers aren’t a one stop solution to potential breaches.

Third Party Services

Many resort to the use of third-party services or payment portals such as Amazon-pay, Apple-pay or PayPal. These services add a layer to the transaction process by channeling your payment through a digital wallet. In the event of a breach, only the wallet and its information are vulnerable, protecting your credit, debit card or bank account. While this is an effective solution, these third-party services require integration with vendors and are thus not ubiquitously available. , meaning that you’ll still have to use a different method of ensuring privacy.

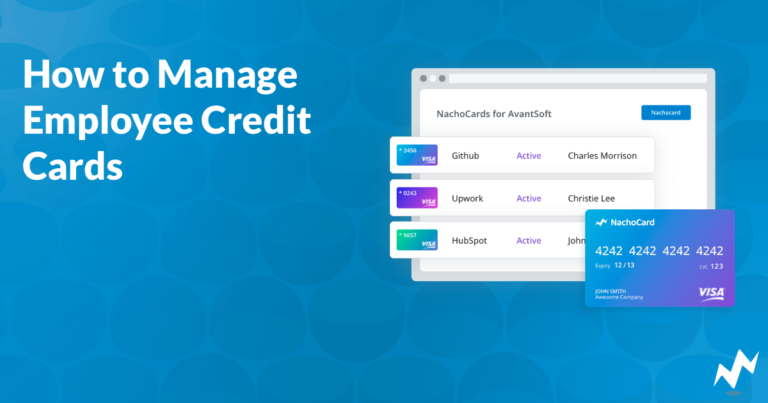

Virtual Credit Cards

Although some vendors may not integrate with third-party services, every payment portal is optimized for the use of credit cards. Companies like NachoNacho provide virtual credit cards that you can assign per vendor, with custom spending limits and date restrictions. Using a unique card for each vendor significantly mitigates the risk of a breach. Individual credit card numbers for each card protect your personal bank or card information, but will ensure that any breach is kept separate from all your other vendor accounts, isolating the problem. Once click cancellation enables quick action in closing the impacted payment source, and creating a new card for the vendor.

Sign Up and Create Virtual Cards – Free for life if you sign up before August 30th!