AI in Fintech: How it Works and Best Tools

We’ve all seen the headlines: AI is taking over! From self-driving cars to medical diagnosis, artificial intelligence is rapidly changing the world around us. And Fintech is no exception. With an increasingly complex economic landscape, financial service companies need powerful tools to keep up. Here’s where AI in Fintech comes in.

AI in Fintech is reforming everything from fraud detection to personalized financial advice and software discovery. Let’s take a closer look into all the ways AI in Fintech is changing how businesses manage their finances.

What is AI in Fintech?

Now, let’s get into the field of AI and its rapidly growing influence on the financial service market. But first, what really is AI? It is a generic term under which there is a suite of technologies designed to mimic human intelligence. Think of it as a very powerful toolbox filled with:

- Machine learning algorithms that learn from data

- Neural networks inspired by the human brain to classify images

- Natural language processing that enables computers to understand human language

After all, AI is not new in finance. The pioneers used simple algorithms for things like credit scoring back in the 1960s. However, the recent explosion in data and computing power has fueled a new wave of AI innovation.

Currently, we’re seeing a proliferation of AI-powered applications in areas such as fraud detection, personalized wealth management, algorithmic trading, and automated loan processing. In fact, a staggering 73% of the time spent by US bank employees has the potential to be impacted by generative AI. This breaks down further into 39% of tasks being automatable and 34% being augmented by AI, significantly changing the nature of work in the financial sector (Source: Accenture).

As AI continues to evolve, we can expect even more groundbreaking applications to emerge, reshaping the way we interact with financial services.

AI in Fintech: Powering the Future of Financial Services

We’ve discussed the base of AI in finance; now, let’s take a deep dive into its real-life applications that are changing the way financial services operate.

Software Procurement

Software tools are critical in any business. They fully sustain the operations and without them, they couldn’t run. This is why companies use dozens or even hundreds of software tools, counting for a large portion of the budget.

And with all the new tools launching every month, it’s a matter of keeping up or getting left behind. But with the oversaturation of online tools, it’s challenging to find the ideal solutions. AI in Fintech software can help with this.

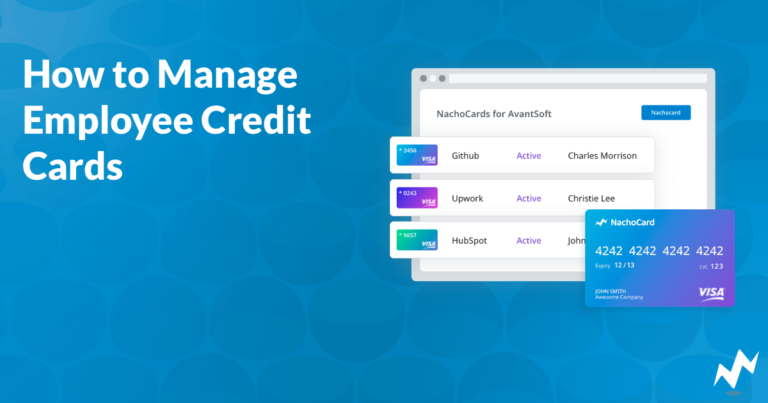

NachoNacho offers a free AI assistant you can ask any questions about software, making your decision process easier. It uses information from the NachoNacho SaaS marketplace, which includes over 800+ of the best tools in the market. With all of this information and data from other sources, it can recommend the best software solutions for your specific needs.

Fraud Detection and Prevention

Fraud is always lurking in finance. However, AI SaaS tools can analyze vast reams of transaction data to detect patterns and anomalies that might otherwise remain invisible to human eyes. These also learn from past fraudulent activities, thus continuously improving the capability of detecting suspicious behavior in real time.

For instance, imagine a system that flags the abnormal sudden spike in money transfers overseas from your account, perhaps stopping the hacker dead in his tracks. That’s the power of AI in action.

Success Stories: AI-powered systems have seen a major reduction in fraud losses by banks like JPMorgan Chase. Their researchers developed an AI system using big data and deep learning to proactively identify phishing emails and other threats targeting bank employees.

Benefits Beyond Human Capability: AI goes beyond the conventional techniques of having to sift through large data sets for the identification of subtle patterns that might go unnoticed by human eyes. Not only this, but it also provides 24/7 vigilance, thus making it a strong defense against fraudsters.

Risk Management

AI in Fintech can also help with risk management. It analyzes financial data and can determine creditworthiness, allowing the prediction of loan defaults with increased accuracy. This enables the lender to make more informed decisions on accepting loans from qualified borrowers and helps in risk mitigation.

More than just Credit Scores: AI-enabled predictive analytics move beyond traditional credit scores. It considers a wider range of factors that help map out a comprehensive risk profile of each borrower. Real-time risk monitoring systems reinforce security by continuously sifting through market trends and flagging any impending issues well in time before they could blow out of proportion.

Customer Service and Experience

Gone are the days of frustrated customers wanting to speak to managers. Today, AI-powered chatbots and virtual assistants are at your service, answering questions and guiding through financial services 24/7. Imagine a friendly AI Fintech assistant helping your customers navigate complex online banking features or even helping fix simple account issues.

Personalization is Key: By analyzing your customers’ financial data and behavior, AI can suggest products and services in line with their needs. Such a level of personalization can seriously help to improve customer satisfaction and loyalty.

Investment Management

For investors, AI is the edge in the market. Algorithmic trading makes use of AI, analyzing market data and executing trades at high speed and with a lot of precision. This means that the reaction time can be faster and returns potentially greater.

Another innovation enabled by AI is the robo-advisor. These are automated platforms for investment advice and portfolio management, delivered at a lower cost than conventional human advisors.

AI in action: At BlackRock Systematic, transformers power state-of-the-art NLP across an incredibly wide variety of data sources to discover hidden investment opportunities.

Regulatory Compliance

For a financial institution, regulatory compliance is a complicated and time-consuming process. Much of the work related to compliance can be automated by AI, saving human resources and reducing the occurrence of errors. AI-enabled systems can track changes in the regulatory environment, ensure compliance, and generate reports automatically. This means huge savings on costs and efficiency for the financial institutions.

Through the power of AI in Fintech, financial services are being transformed at their very core. And AI is forging a more secure, efficient, and customer-centered financial landscape.

The Advantages of AI in Finance

The applications of AI in Fintech paint a clear picture: AI is a game-changer. But what does this mean for the industry as a whole? Let’s explore the key benefits AI brings to the table.

Enhanced Efficiency and Productivity

AI frees human workers to do high-value activities by automating repetitive tasks. For example, loan servicing involves a wide array of processes, from managing customer accounts and processing payments all the way to delinquencies and foreclosures.

Through loan servicing automation, automated custom report generation, automated communication with borrowers, Bryt Software capitalizes on AI’s capability to enhance the productivity of loan servicing teams. This lets loan servicers spend more time and effort on difficult cases and deliver greater customer experiences to borrowers.

Cost Reduction and Operational Savings

Automating with AI reduces reliance on manual labor for financial institutions, which translates into substantial cost savings. AI also optimizes operations, identifying inefficiencies in the process and eradicating them.

These cost reductions can, in turn, be transferred to the customers in the form of reduced fees or better interest rates.

Improved Decision-Making Processes

AI empowers financial institutions to make better decisions with advanced data analytics. By looking through the gigantic amounts of data, AI can discover trends and patterns that may be potentially overlooked otherwise. This leads to better risk assessment, better credit scoring, and, in the end, the attainment of better financial decisions.

Accuracy on Autopilot

Human error is a constant concern in financial operations. AI, on the other hand, thrives on accuracy and consistency. AI algorithms process tasks with minimal errors, hence reducing the chances of mistakes and ensuring that financial systems work seamlessly.

In short, AI in financial services drives efficiencies, brings down costs, enables smarter decision-making, and ensures greater accuracy. These advantages set in motion a far more solid, safe, and customer-oriented financial environment.

Best Fintech with AI

Aside from being the largest and best software and service marketplace, NachoNacho also incorporates multiple AI tools to help businesses save more money.

Shaman is one of those AI tools, which allows you to get all the answers you need to your software buying questions. Ask whatever is on your mind to help you decide which software tool is best for you. For example, if you’re looking for a CRM for a small business. Just ask that. You can also get pricing information, discounts, compare tools, and much more.

This AI Fintech tool also has the power to analyze your current technology stack and recommend software you might be interested in. It’s all automatic, making your software procurement process much easier.

Challenges and Considerations for AI in Fintech

While AI offers great possibilities for financial services, it is not without its challenges. Here are some key areas to consider:

Ethical Navigation of AI in Fintech

AI algorithms are only as good as the data they have been trained on. Biases within that data can lead to discriminatory outcomes, such as unfair loan rejections or biased investment advice.

It’s critical that there is ethical development and implementation of AI to avoid discrimination and ensure fairness within the financial system.

Your Data, Your Privacy

AI is heavily reliant on a vast amount of personal financial data. The security of this data, as well as preserving privacy, is very important for you and your organization.

Robust data protection measures and clear communication with customers regarding data usage will be essential in building trust and mitigating privacy concerns.

Protection from Security Risks

The implementation of AI systems has introduced new security vulnerabilities. Hackers could potentially exploit these vulnerabilities to manipulate data or disrupt financial operations.

Financial institutions need to prioritize cybersecurity measures to prevent such risks.

The Future of Financial Jobs

There is a need for proactive workforce development programs to be implemented. This will equip your existing employees with the skills that they need for the AI-driven financial landscape.

Regulation

The rapid pace of AI development requires robust regulatory frameworks to manage potential risks and ensure the responsible development and use of AI in financial services.

Regulation should aim to strike a balance: fostering innovation while mitigating risks and safeguarding consumers.

Future Trends of AI in Fintech

We have seen the current landscape of AI in finance, but what does the future hold? Let me elaborate:

- Fintech Frontrunners: Fintech startups are the topmost innovators of AI in finance. Expect them to keep on innovating cutting-edge AI-powered solutions that are transforming traditional financial services. These may range from hyper-personalized wealth management to AI-driven underwriting of insurance, taking into account alternative data sources to capture the entire risk spectrum.

- AI & Blockchain: The integration of AI with blockchain technology is going to be a game-changer in financial services. The secure and transparent features of blockchain can provide a secure platform through which AI algorithms can function to bring in trust and transparency in AI-powered financial applications. Imagine a world in which smart contracts powered by AI can execute complex financial transactions with increased efficiency and security.

- Looking Ahead: Fast forward ten years from now, and AI in fintech will be seamlessly integrated into financial services. Here are a few possible prophecies for that era:

- Hyper-personalized experiences: AI will personalize every aspect of your financial life. This may range from automated budgeting and savings plans to robo-advisors who tailor investment strategies to your needs and risk appetite.

- Democratization of finance: Financial services will become more accessible and cheaper to everybody, regardless of income or net worth.

- Enhanced risk management: AI will allow the real-time assessment of risk. Therefore, financial institutions will have to identify and attempt to mitigate all possible threats with unprecedented accuracy. This may lead to a more stable, resilient financial system.

- Evolving Role of Human Advisors: The role of human financial advisors would shift more toward delivering specialized services. This can include the intricate aspects of wealth management and estate planning, using AI in analytics and related administrative work.

The future of AI in finance promises to be boundless. By embracing these advances and taking up the challenge responsibly, we are all headed toward financial security, inclusivity, and prosperity.

The Bottom Line

Moving with the wave of AI in Fintech requires finding that delicate balance. It is essential to encourage innovation, but at the same time, it is very important to control risk and exercise development responsibly.

Addressing these challenges upfront, we can unleash the potential of AI. This isn’t merely about keeping up the pace. It’s about harnessing the immense power of AI to rewrite the financial rulebook, ensuring everyone has the tools and opportunities to thrive.

If you would like to receive the latest deals added to NachoNacho, make sure you sign up for our newsletter below. We’re adding amazing software discounts you can’t miss!

Sign up for our newsletter