Prepaid Business Cards: Are They Adaptable For Increased Software Spend?

Prepaid cards allow for efficient, centralized management of company spend, offering team members flexibility in subscribing for tools/products such as continued Human Resources, Recruiting, position related expenses, and even some software products to be used by the team. Empowering your employees to spend using a prepaid business card, in this sense, seems like a win-win for the business. However, where these cards fall short is the lack of flexibility in spend. This stagnant prepaid card can’t adapt to the needs of dynamic, distributed teams over the long run as the card will continuously be replaced with another, leaving the task mundane and time consuming. In addition, what if the amount on the prepaid card does not match the total spend on software, leaving excess waste? Prepaid business cards, meet many business needs but don’t address a number of pain points.

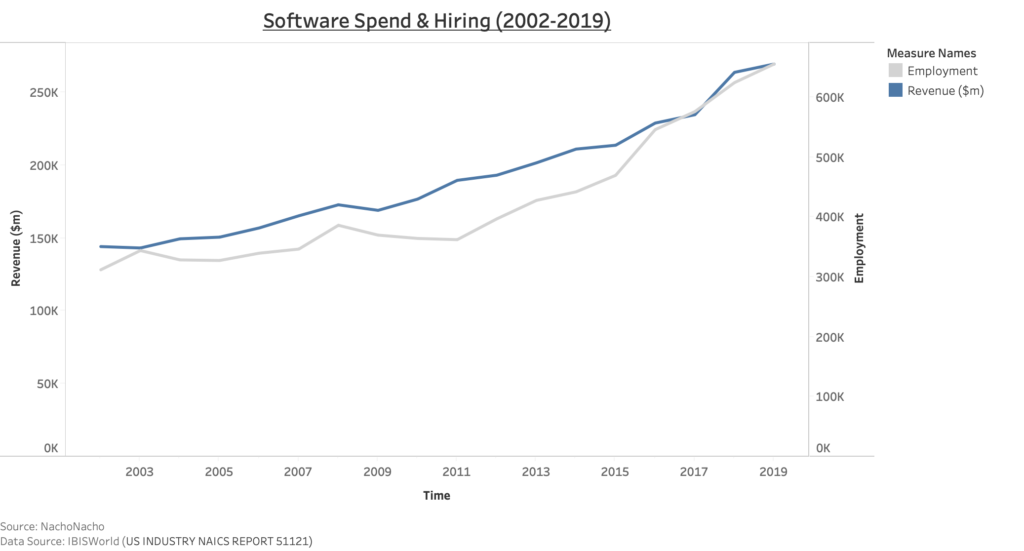

As we see below, the overall spend on software in the United States is continuously growing, coupled with the rising employment through 2019. What this highlights is the reliance of software we, as business owners, have on our daily operations. With this in mind, having a card that is adaptable to business needs that are ever-changing is paramount.

What NachoNacho has done was take this idea of a prepaid business card and gave it life. The NachoCard, through the ability to manage expense limits instantaneously across your entire company from one management portal, allows for teams to get the benefit of a prepaid business card without the hassle. The ability to manage any business spend, increase (or decrease) limits, and cancel a card at any moment, users no longer need to worry about the lost money on a prepaid business card. This allows for greater flexibility in spend management while providing the desired freedom for your team to act in a responsible, fast paced environment.