How to Manage Employee Credit Cards

Whether your employees need to pay for frequent business travel expenses or renew SaaS subscriptions to streamline workflow, getting them employee credit cards can be useful.

It is one of the most convenient ways to enable employees to make quick decisions and purchase what they need. At the same time, employee credit cards make it easy for businesses to allocate budgets, track expenses, and save time.

Let’s take a look at ways in which you can manage your employee credit cards efficiently.

Set Guidelines on How Employees Should Use Their Corporate Cards

Employee credit cards can help you save the time spent on gathering receipts and reimbursing expenses. You can get clear visibility of where the money was spent.

However, you should set clear guidelines on how employees can use their corporate credit cards.

You should:

- Set eligibility criteria for business credit cards.

- Define what types of purchases the employee can make.

- Set spending limits on your employee cards for each month.

- Block access to cash advances as they can be quite expensive and also lead to fraudulent activities.

- Make it necessary to get approvals for high-value purchases.

- Set guidelines for handling card usage violations in advance.

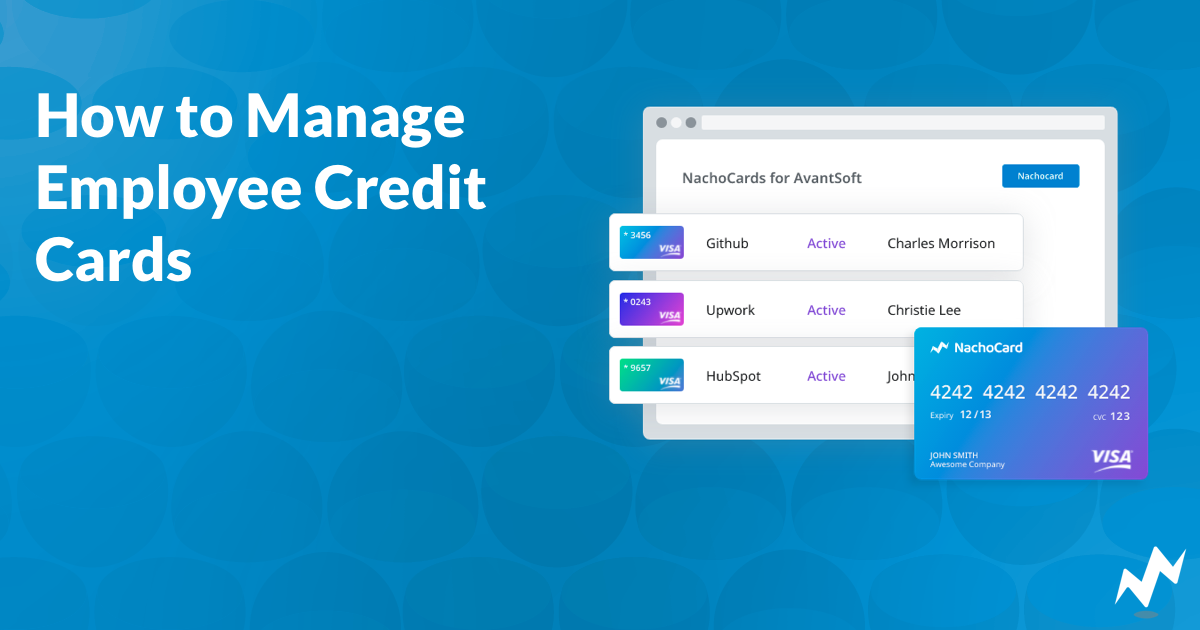

Use and Manage Virtual Employee Credit Cards

Another solution to manage employee credit cards is to create and give virtual cards that are easier to track, manage, and block.

Companies like NachoNacho provide virtual credit cards that you can assign per vendor and give access to any of your team members. It allows you to set spending and date limits and also gives you the authority to suspend or cancel a NachoCard at any time.

Get notified when a team member uses the card to pay any of your vendors. You can get all details including the vendor’s name, account holder’s name, payment amount and date, and payment status.

And the best part?

You can easily integrate it with your work tools such as Slack and Google Chrome (Chrome extension available).

Migrate all your SaaS subscriptions into one company-wide NachoNacho account for quick and hassle-free expense tracking and recordkeeping. You can start your free month today and then pay $5 per user per month.

Review Your Accounts on a Frequent Basis

While doing it on your own can be highly tedious and time consuming, you should hire an account manager to regularly review account statements. Many businesses streamline this process by using digital tools like a reliable paystub generator alongside their expense management system to maintain comprehensive financial records.

Keeping a close eye on the use of each of your employee credit cards can help you catch fraudulent activity early and prevent heavy losses.

Are You Ready to Save Money and Time on Managing Your Business Expenses?

Business credit cards have become a necessity for medium-sized businesses and large corporations. But it is important to track and manage your employee credit cards efficiently and regularly to prevent fraud and losses.

Do you need more tips to manage your employee credit cards and company expenses? Feel free to discuss it in the comments below.