How to avoid overcharges on your SaaS products

It’s never a good feeling when you open up your Quickbooks or your business credit card statement and see that you accidentally paid more for a subscription than you wanted to. Maybe you didn’t realize a SaaS business was raising its fees or maybe you didn’t know that the vendor charged based on usage.

Let’s go over how you can avoid those pesky overcharges to save your small business money.

What is a SaaS overcharge?

A SaaS overcharge is anytime you pay more for a subscription than you expected. This is different from forgetting to cancel a subscription. There are other methods for avoiding that type of wasteful spending.

SaaS overcharges happen when your card is charged more than you expected. For example, if you subscribe to the basic plan of Evernote, but then you look at your statement and the payment was two dollars more per month than you expected, that would be an overcharge.

Save money when you sign up for SaaS products in NachoNacho’s exclusive marketplace. Save up to 30% a year on your products.

Why do SaaS overcharges occur?

SaaS vendor raising their price

There are a number of reasons your card might be charged too much. For starters, it might be as simple as the SaaS vendor raising its prices. Netflix has raised its prices several times over the past few years, and Netflix subscribers might not always know those price increases are coming. That’s an example of an overcharge.

Usage-based pricing

Another reason why overcharges might occur is that the SaaS product uses usage-based pricing. Think of it like a pay-as-you-go cell phone plan. If you only paid for 500 minutes, but without knowing you actually used 600 minutes, your cell phone vendor will automatically charge you for the extra 100 minutes. That’s another example of an overcharge.

Using premium features

Another reason a SaaS overcharge might occur is if you access a feature that is only available in a higher plan, and the SaaS vendor automatically charges your card for it. Some vendors will charge extra for specific search features or analytics. Some vendors have a pop up that will warn you before you access that feature, but others hide the extra fees in fine print and you might accidentally pay for it.

Adding another user

Some SaaS businesses are based on per user pricing, which means you pay for every new user or they are split up into tiers based on the number of users in your account. If you add a new user to your account, the business might charge your credit card automatically. This might not be very drastic if the cost per user is minimal, but for SaaS pricing models that are tiered, just one new user might bump you up to a much more expensive plan.

That’s a lot of cash when you’re trying to run a profitable business.

How you can avoid SaaS overcharges

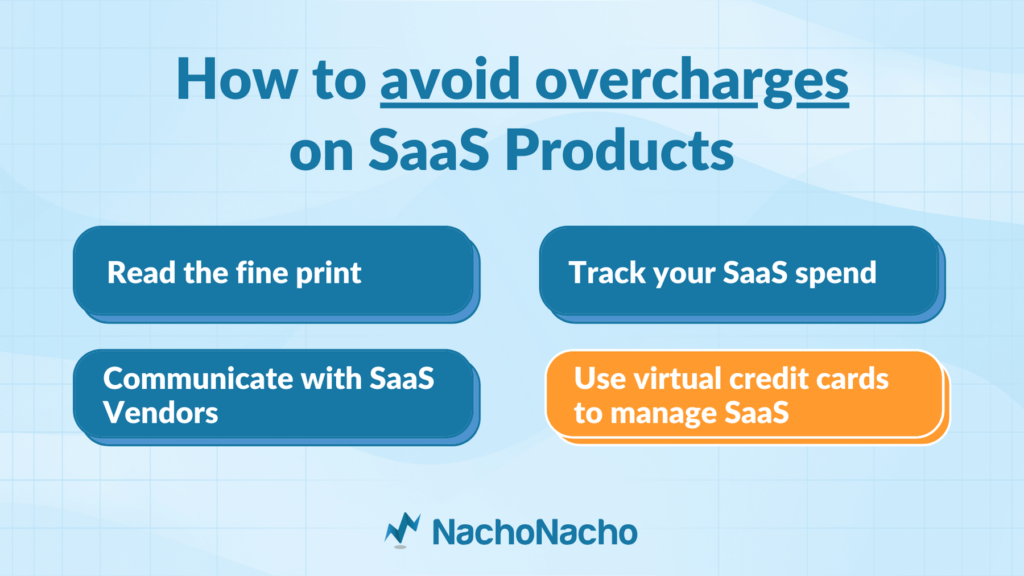

Read the fine print

There are many easy methods you can use to make sure you avoid SaaS overcharges. The first might seem obvious, and you have probably heard it many times before, but you should read all the fine print before you make any payment. Many SaaS companies will hide clauses that will result in overcharges in that fine print, and you can avoid it by simply reading the agreements thoroughly.

Track your SaaS spend

Make sure you have an accurate tracker of your SaaS spend. You won’t know if you are being overcharged for your subscriptions if you don’t actually know what you are paying per month. You should check this tracker every month, or you could have overcharges go on for months before you actually notice.

Communicate with SaaS Vendors

You should communicate with your SaaS vendors regularly. Make sure you ask if there is anything that you could incur an upcharge for. You can also ask if there will be any price increases in the coming months.

Use virtual credit cards to manage SaaS

Even if you do all of these steps, you might still incur overcharges. A foolproof way to avoid this is by using NachoNacho virtual credit cards. You can set a monthly spending limit on each card, and pay for each SaaS vendor with a different card, so you will never experience an overcharge again.

Get started with NachoNacho virtual credit cards here and never experience overcharges again.

We’d love to hear what you think. Connect with us on Twitter: @getnachonacho